Bond Market Selloff Resumes

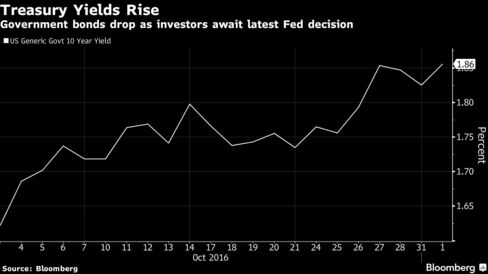

Treasury 10-year notes slid before the Federal Reserve’s latest interest-rate decision on Wednesday, with futures trading showing 71 percent odds of an increase before the year is out. Banks were among decliners in European stocks, reversing an earlier gain in the Stoxx Europe 600 Index.

Signs of improvement in China are providing some relief to investors after global equities last month had their biggest loss since January, weighed down by an underwhelming batch of corporate earnings and indications that major central banks are starting to turn away from ultra-loose policies.

Treasury 10-year yields increased three basis points to 1.86 percent as of 9:11 a.m. London time, while those on German bunds with a similar due date increased four basis points to 0.20 percent.