L’essentiel: les préoccupations sur la soit disant Trade War, les tensions sociales en France, la baisse des Bourses, porteuses de crise possible, Powell, les taux, les FANG …tout cela contribue à la pression sur les Bourses.

Tout cela constituent des prétexte pour des marchés qui ont une gueule spontanée à baisser pour des raisons endongènes.

Jerome Powell: tient des propos qui tranchent sur ceux de ces prédesseurs.

* »We will know the labor market is getting tight when we do see a more meaningful upward move in wages. »

* Doesn’t over-estimate policy effects

* Respects research literature and empirical data

* Equates monetary policy with Fed Funds targeting, not QE

* Knows GDP is driven by productivity+labor partic

* Sees cost of capital as one, not principal, factor

Bloomberg] Dollar Down, Stocks Swing as Fed Sticks at Three: Markets Wrap

[Bloomberg] Trump to Announce $50 Billion in China Tariffs, Sources Say

[CNBC] US vows to defend farmers from possible China trade action against soybeans

[CNBC] Congress just released its massive spending bill: Here’s what’s in it

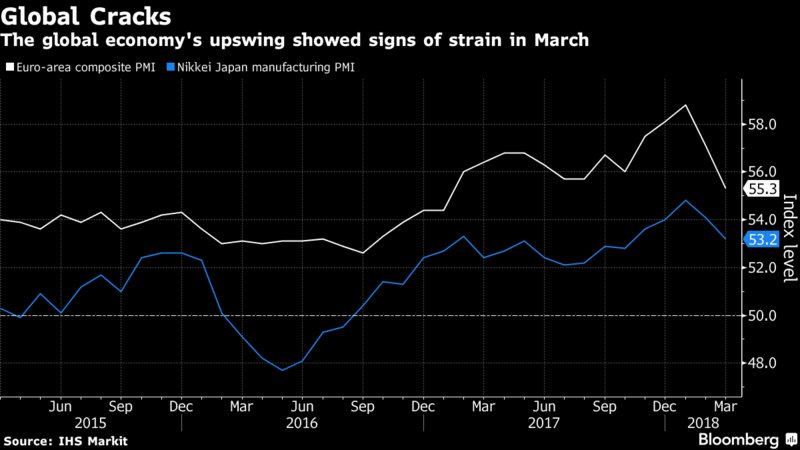

Rappel: nous avons a plusieurs reprises signalé que la croissance globale avait tendance à se régulariser voire à se tasser , ceci semble de plus en plus net selon les enquêtes Markit :

[Bloomberg] China’s Central Bank Raises Borrowing Costs After Fed Hikes

[Reuters] Chinese paper says China should prepare for military action over Taiwan

[NYT] Trump Plans to Slap Stiff Tariffs and Investment Restrictions on China

[WSJ] U.S., China Sharpen Trade Swords

[WSJ] Sorry, But The Fed Will Be Safe Not Sorry

[FT] Fed chair Powell sets tone with first policymaking meeting

[FT] Jay Powell fails to sway investors following the ‘dot plot’

[FT] Triple B risks lurking in the US credit market