Un document qui prouve que depuis la crise le recours à l’endettement a continué de progresser et que les ratios de dettes ne cessent de grimper .

On fait beaucoup plus de tout ce qui a produit la crise.

Cela s’appelle l’addiction.

La bonne question: Next Debt Crisis: Will Liquidity Hold?

: Prochaine crise de la dette: la liquidité sera-t-elle maintenue?

Contents

Section 1. Next Crisis? 2 minutes to read Pg. 1

Section 2. Key Risks: Market Capacity, China’s Corporates 8 minutes to read Pg. 4

− Section2A. Market Capacity Risk Pg. 5

− Section 2B. China Corporates Pg. 9

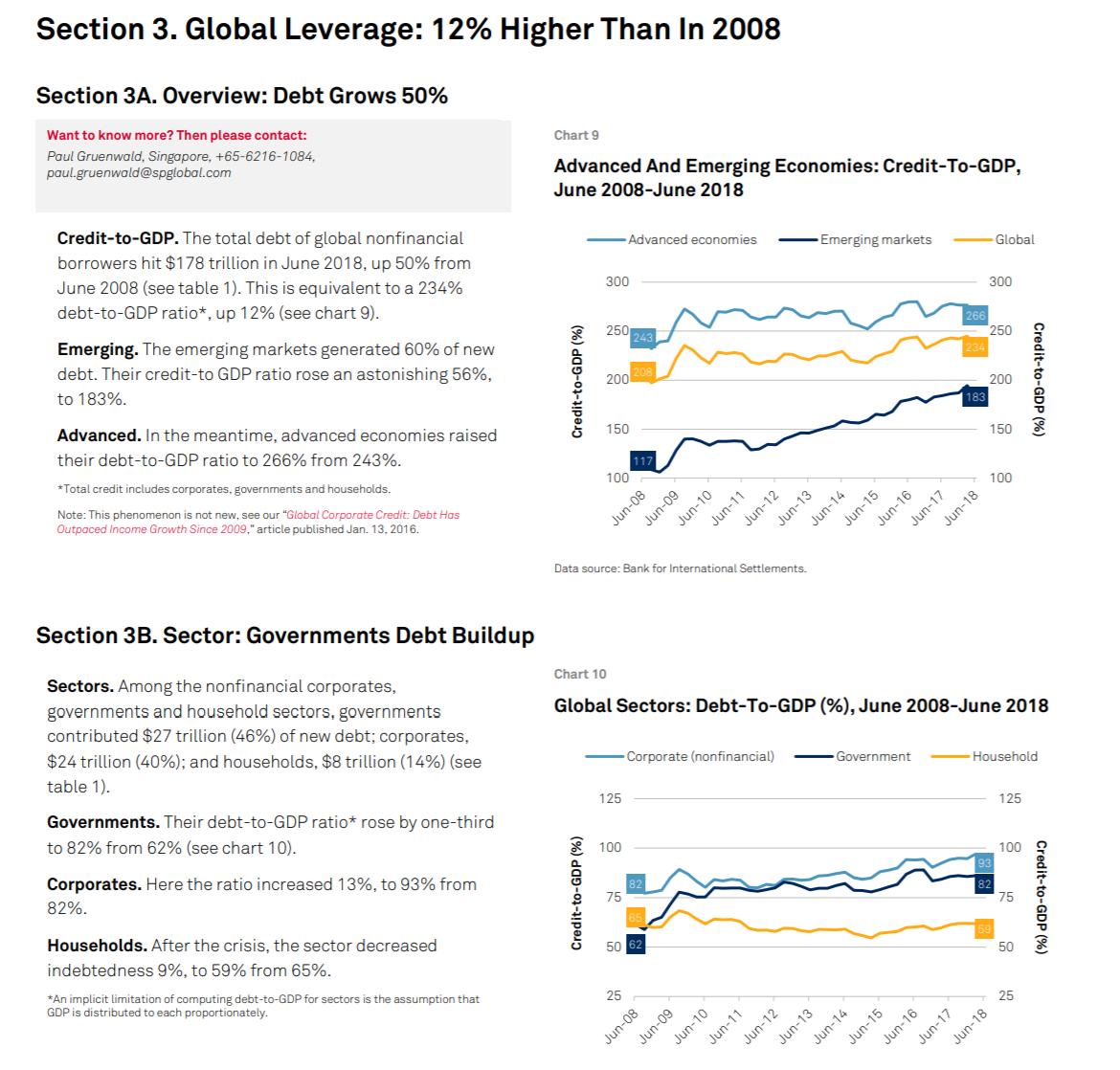

Section 3. Global Leverage: 12% Higher Than In 2008 5 minutes to read Pg. 10

− Section 3A. Overview: Debt Grows 50% Pg. 10

− Section 3B. Sector: Governments Debt Buildup Pg. 10

− Section 3C. Economies: Emerging Markets Comprise A Third Pg. 13

Section 4. Corporates: Financial Risk Is Higher 4 minutes to read Pg. 15

− Section 4A. Overview: Debt-To-EBITDA Higher Pg. 16

− Section 4B. Economies: China Takes Center Stage Pg. 17

Section 5. Rating Trends: Down Over The Past Decade 1 minute to read Pg. 19

− Appendix 1. U.S. Corporates: Cash Holdings Pg. 22

− Appendix 2. Data Sources: BIS And IIF Pg. 23

− Appendix 3. Debt Servicing Ratios: Sample Countries Pg. 26

− Appendix 4. Governments: Debt Growth And Credit-To-GDP Pg. 31

− Appendix 5. Corporate Sample: Financial Risk Categories Pg. 32

Cliquer pour accéder à global-debt_will-liquidity-hold-v11mar2019.pdf