Chute des banques italiennes: toujours les craintes budgétaires.

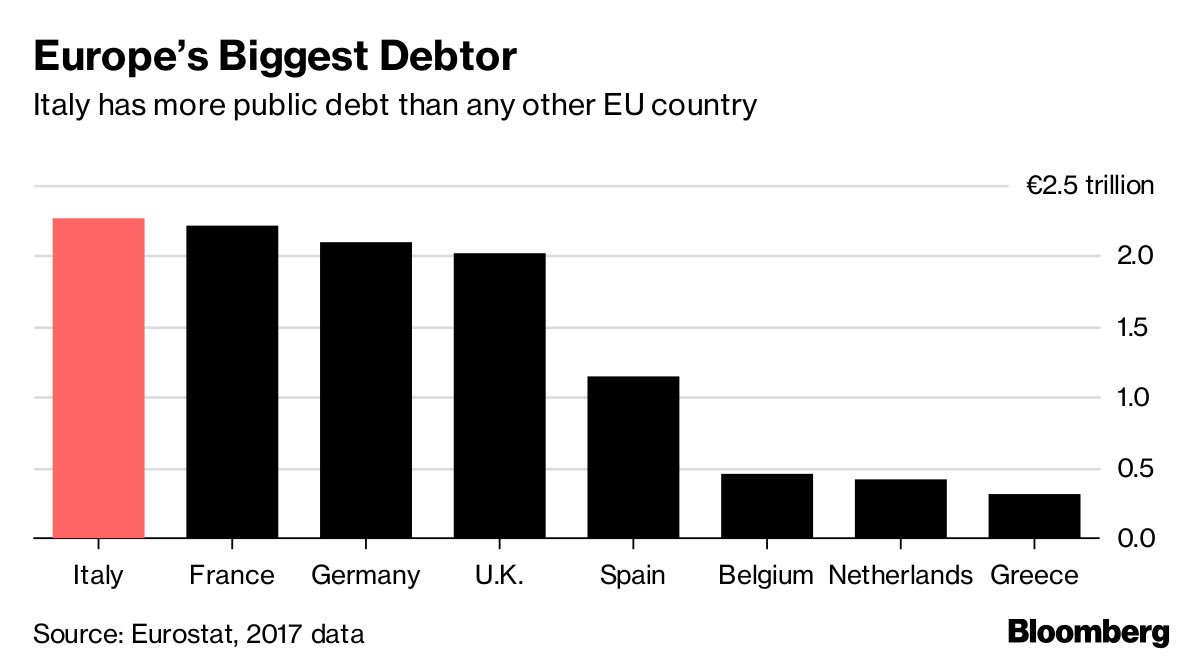

Rappel les dettes publiques en Europe.

Le dollar remonte:

Feldstein, dans le WSJ : une autre récession menace;

Le niveau des prix des assets rappelle celui de l’immobilier en 2008. Les prix des actions vont baisser drainant la richesse et les ressource des consmmateurs. La Fed n’ que epu de marge pour soutenir l’activité.

Ten years after the Great Recession’s onset, another long, deep downturn may soon roil the U.S. economy. The high level of asset prices today mirrors the earlier trend in house prices that preceded the 2008 crash; both mispricings reflect long periods of very low real interest rates caused by Federal Reserve policy. Now that interest rates are rising, equity prices will fall, dragging down household wealth, consumer spending and economic activity.

[Reuters] Italy budget worries hit European markets

[Reuters] Oil prices edge up amid uncertainty over fallout from Iran sanctions

[Reuters] U.S. consumer spending increases steadily in August

[Reuters] Italy raises deficit target, defies EU and rattles markets

[BloombergQ] Goldman Sees Italy Junk Risk Leading to ‘Sudden Stop’ of Capital

[BloombergQ] Euro-Area Inflation Rate Climbs Above 2 Percent on Energy

[Reuters] Global M&A volume flattens in third quarter as trade tensions loom

[BloombergQ] Emerging Asia Feels Pain as Fed Tightening Ripples Across Region

[BloombergQ] China’s Belt and Road Is Buckling

[WSJ] Emerging Markets’ Double Whammy: Expensive Oil, Weak Currencies

[WSJ] Inflation Rears Its Head in China

[WSJ, Feldstein] Another Recession Is Looming

[FT] Italian bank shares stung by surge in government bond yields

[FT] Global M&A activity hits record level

[FT] Prospect of rate rises precipitates bond fund outflows

[FT] India’s corporate debt traders suffer crisis of confidence

[FT] India’s corporate debt traders suffer crisis of confidence